Online

Breaking down market behaviour, execution logic, and risk management — through in-depth articles that transform complex price action into clear, repeatable frameworks for disciplined, long-term decision-making.

Most trading accounts fail not because of bad analysis, but because of poor position sizing. Learn why exposure control is the foundation of long-term trading survival.

Entries do not define a trading strategy — risk management does. Learn how institutions use disciplined risk control to survive drawdowns and perform consistently across market cycles.

Perfect entries do not create consistent traders. Execution quality does. Learn why institutions focus on efficient execution, risk control, and process rather than exact price precision.

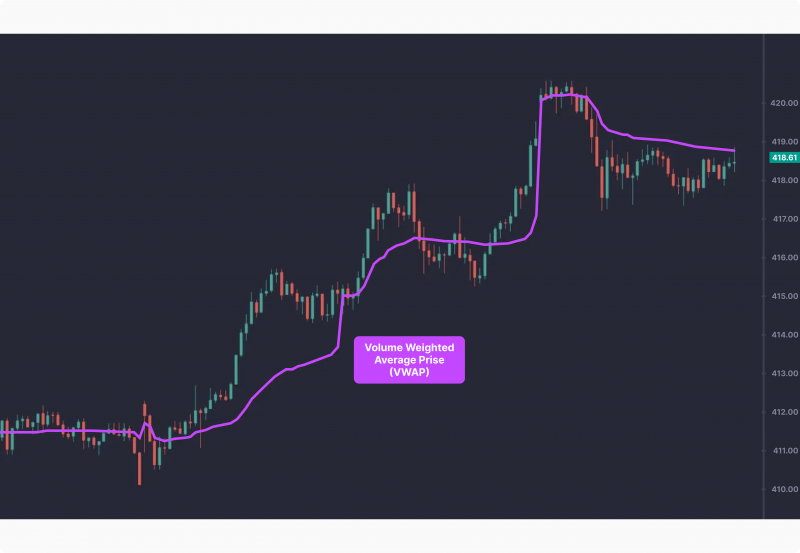

VWAP is not a buy or sell signal. It defines fair value. Learn how institutions use VWAP to measure execution quality and assess whether price is trading at a premium or discount.

Equal highs and equal lows are not random price behavior. They reveal where liquidity accumulates and why markets often spike, reverse, or fake out retail traders.

Price does not move because of indicators or patterns. It moves to access liquidity. This guide explains how liquidity drives price action and how professional traders view the market.

The New York session reacts to earlier market structure. Learn how institutional traders identify continuation, distribution, or reversal using session context and liquidity behavior.

The London session is driven by institutional commitment, not random breakouts. Learn how capital participation, Asian context, and liquidity discovery shape London price action.

The Asian trading session is often misunderstood. Learn how balance, liquidity conditioning, and reference levels formed during Asia shape price behavior in London and New York.

Discover how financial markets truly move through liquidity, institutional participation, and global trading sessions. Learn how Asia, London, and New York shape volatility and price direction.